Finance Explained...

So you can make the best financial decisions for YOU, your family & your futures!

Join 1,000s of Family Finance Moms who get free weekly updates!

Listen to Finance Explained.

A 5⭐️ rated weekly podcast, covering the top 3 financial news items of the week, along with a deep dive on the finance or economic topic that matters most to YOU in 30 minutes.

Read the blog.

Budgeting, saving, investing. Stocks, bonds, insurance, mortgages... finance explained in a way YOU can understand and apply to your personal finances to change your future.

Join a workshop.

LIVE and pre-recorded hour-long sessions on budgeting, investing, and economics to build your financial literacy.

Be Part of the Family Finance Mom Community

Private Group

Finance Explained for YOU and by YOU in a private group where you can feel safe sharing your experiences and getting your financial questions answered.

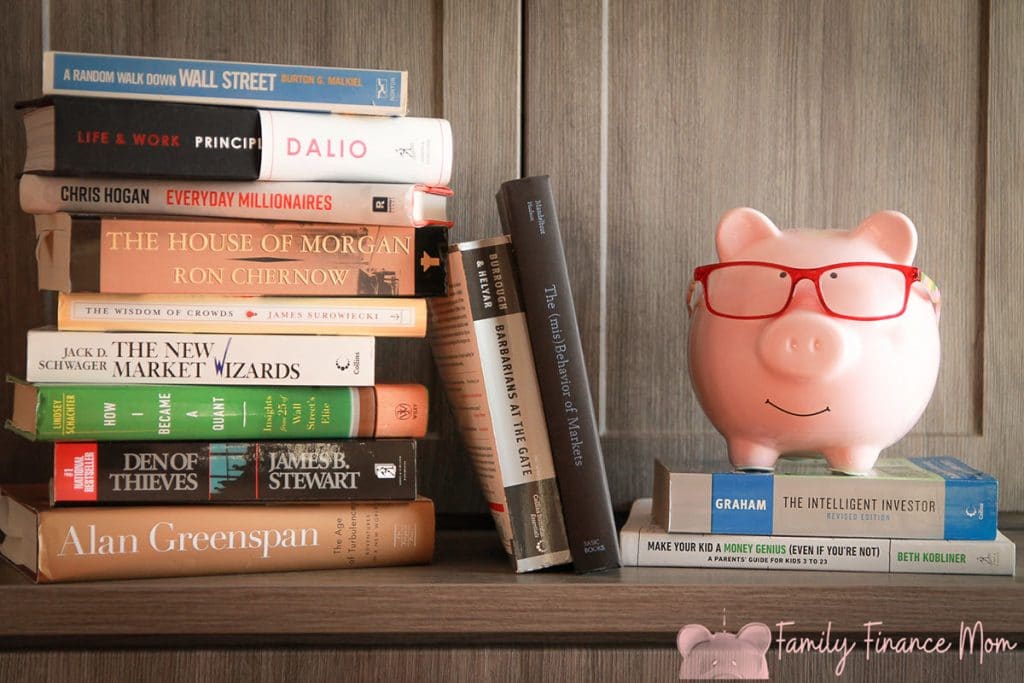

FFM Book Club

Join in the discussion as we read one finance book each quarter. Catch our current read and see the full list of past club picks.