How to Choose the Best Investment Accounts for Beginners

Heading into the new year, you all expressed a desire to learn more about investing and planning for retirement. This post kicks off a series on How to Invest Money (When You're Just Getting Started)... it starts at the beginning with choosing the best investment accounts for beginners. Because before you can invest a single dollar in the market, you've got to get your money in an account you can actually invest from! I will outline your options, in terms anyone can understand, and highlight the key choices you have to make along the way. Here we go...

The Best Investment Accounts for Beginners

By the time you earn your first paycheck, you likely opened your first checking account. You may also have opened a savings account to set aside money you don't want to spend right away, to build an emergency fund or set up sinking funds for things you want to save for overtime.

But neither a basic checking or savings account allows you to then invest those funds. You'll need to put your money into an account that allows you to invest first. Why?

Because investing, unlike your checking or savings account, carries the risk of loss (as well as potential gains). To protect investors and make sure they are aware of and properly informed of these risks before they invest, the broker-dealers and investment advisors who offer these accounts are subject to additional regulatory requirements, and your investment accounts have more reporting requirements as well.

In this post, I will explain the mechanics, uses and investment options for the following best investment accounts for beginners.

- Retirement Account Options

- Education Savings Account Options

- Health Savings Accounts

- Taxable Brokerage Accounts

Why Invest?

If investing subjects you to risk of losing your money, why do people do it?

Because more often than not, the potential gains surpass the risk of loss. Below is a table of the returns for cash (essentially leaving your money in a high yield savings or money market account), as well as other investment options and inflation. Inflation is greater than what you can earn for saving cash - so when you only put your money in a savings account (or worse yet, under your mattress), your savings loses purchasing power every year. To preserve your purchasing power, and build wealth, you have to be willing to take some risk and invest to earn higher returns.

Don't worry about the difference in the various asset classes listed above just yet... we will address those in future posts in this investing series. All you need to recognize is that cash alone in a savings account earns next to nothing, less than inflation, which means you lose purchasing power over time, and investing earns more over the long-run.

Cash in a savings account earns next to nothing - less than inflation - losing purchasing power every year.

- meghan | family finance mom

Investing allows you to put your money to work generating passive income. The compounding of these investment returns, slowly and steadily over time, builds wealth that eventually allows you to stop working and live off the assets, or nest egg, you have grown.

Question #1a:

Taxable or tax-advantaged?

But you need an investment account to start... The first choice you face when it comes to choosing the best investment accounts for beginners is whether to put your money in a taxable brokerage account or choose from several tax-advantaged options.

The critical trade-off you make for the benefits of tax-advantaged options is your money is then typically restricted either by how you can use it, when you can withdrawal it, or both. With a taxable, brokerage account, you can access your investments at any time, sell it for cash and use that cash for any purpose you like... after paying taxes.

Question #1b:

When do you need the money?

Best Tax-Advantaged Investment Accounts for Beginners

I always recommend the best place to start when investing is with tax-advantaged accounts. Why?

These accounts do one or more of the following:

- Save you taxes upfront, allowing you to invest more to start

- Save you taxes on gains along the way, allowing your investments to grow and compound more

- Save you taxes in the end when you withdrawal and use the funds

Tax-advantaged accounts are typically associated with specific investment purposes that align with long-term goals, like retirement, college savings, or health expenditures. So the second question you will want to answer before you start investing is what is your investment account goal? What are you planning to ultimately use the money for? This will then lead you to which tax-advantaged account is the best fit for you, given your savings goals.

Question #2:

What are you saving or investing for?

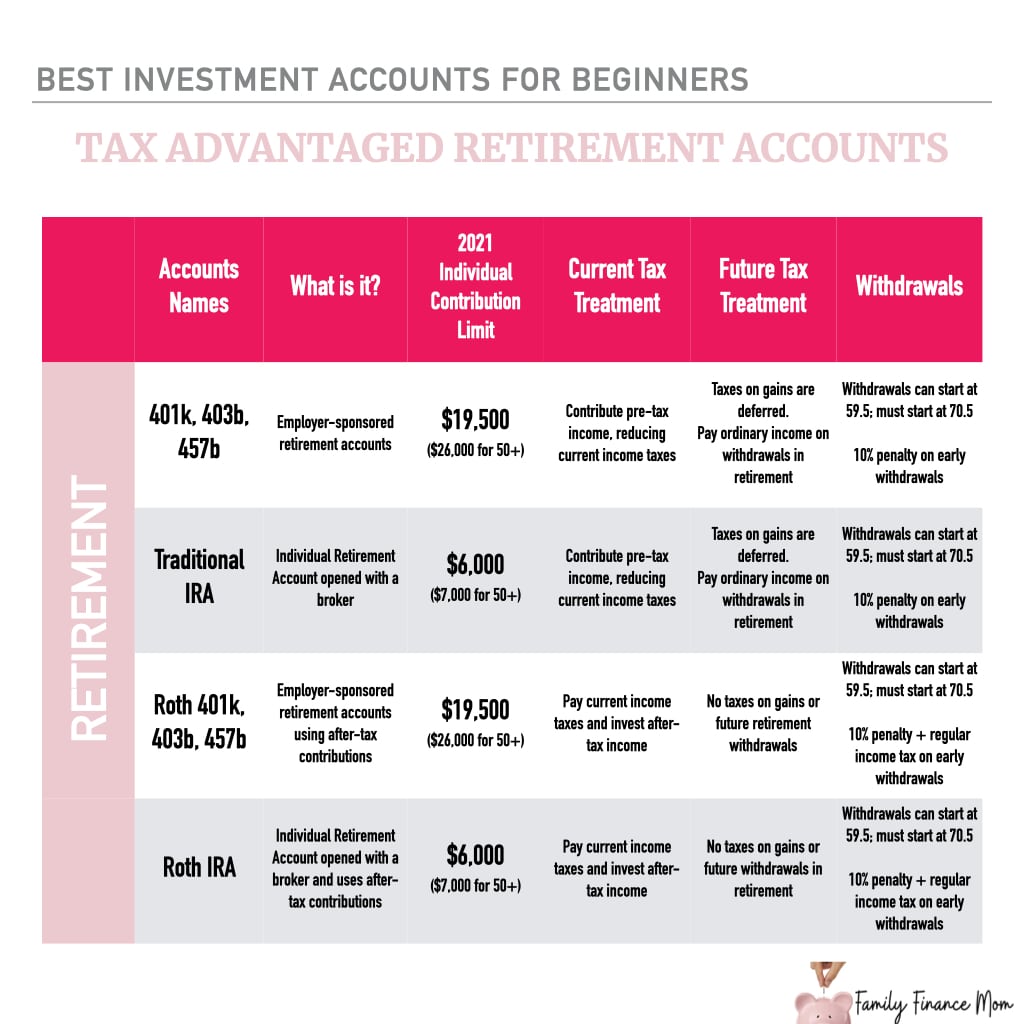

Best Tax-Advantaged Retirement Investment Accounts

In terms of prioritization, I recommend prioritizing your retirement ahead of other long-term goals, like college savings. Why?

Because when it comes time for your kids to go to college, there are many alternatives to pay for it - from loans and scholarships, to work-study programs and grants.

The same is not true when it comes to retirement. But the good news is there are a host of investment accounts for beginners when it comes to saving for retirement.

The table below is a summary of the best investment accounts for beginners when it comes to tax-advantaged retirement savings. I will go into more detail on each of them below, including the differences in tax treament, contribution and withdrawal limitations, how to open an account, as well as how investment options may vary.

Traditional 401(k) Plan

Most major companies offer a 401(k) retirement plan to employees as part of their benefits package. These are also known as defined contribution plans (as opposed to defined benefit plans, more commonly known as pensions). If you are eligible, you as the employee choose how much you wish to contribute to your 401(k) each year. Your contributions are made with pre-tax income, reducing your taxable income in the current year, and come directly from your paycheck each pay period.

401(k) Contributions

The IRS sets an annual employee contribution limit. For 2021, the limit is $19,500, though employees 50 and over may contribute an additional $6,500, known as a "catch-up" contribution. You should always consult the IRS website for current year 401(k) contribution limits, as they do increase in some years. Most employer payroll departments will typically make sure you do not exceed your contribution limit, but should you change jobs mid-year especially, you should make sure you do not exceed the limit, as it can be messy to undo and incur unnecessary tax penalties.

In addition to your employee contributions, employers may also make contributions on your behalf to your 401(k). Some employers offer matching programs and/or payout profit-sharing plans. Employer contributions may be subject to a vesting schedule, requiring you to remain with the company for a period of time before the funds are entirely yours.

For 2021, total annual contributions to your 401(k), including both employee contributions as well as any employer contributions cannot exceed 100% of your compensation or $58,000 (or $64,500 including catch-up contributions).

401(k) Investment Options

We will talk in far greater detail about investment options in later posts, but one of the biggest mistakes I see people make with any tax-advantaged investment account is failing to actually invest the funds. Once you contribute money to your 401(k), you then actually have to select and make investments with it. Otherwise, it is just cash sitting in your account, getting hit with administrative fees, and generating no potential return.

Most 401(k) plan administrators offer a pre-set list of mutual funds participants can choose from, ranging from Target Date funds that align with the year you plan to retire, to various actively managed funds across stocks, bonds and other asset classes.

401(k) Withdrawals

If you leave your employer, you can leave your plan there - but you will no longer be able to make contributions to it. You may choose instead to roll it over into a 401(k) with your new employer or a Traditional IRA. In a roll over, you withdrawal the funds and immediately deposit them in the new retirement account, without paying any taxes or penalties

If you withdraw any funds before the age of 59.5, you will pay taxes at your current income tax rate on the entire amount you withdraw plus a 10% penalty tax. There are some exceptions under which the 10% penalty may be waived.

After the age of 59.5, you are free to make withdrawals without the penalty. However, because you originally made your 401(k) contributions BEFORE income taxes, all withdrawals in retirement are taxable at ordinary income tax rates for the current year.

You may not choose to make any withdrawals up until the age of 70.5. At that age, however, the IRS requires you to begin taking distributions, known as required minimum distributions (RMDs). The IRS provides a worksheet to determine the RMD, but it is essentially based on your current age, general life expectancy, and with a goal of fully distributing your funds before your death so as not to defer your tax obligations indefinitely.

How to Open a 401K

If you want to open a 401K, you will need to

- 1) Work for an employer who offers one

- 2) Be eligible to participate in it as part of your benefits package - this may require full-time employment or you may need to be employed for a period of time first

- 3) If you check the first two options, then you just have to ask your benefits department for the information and complete it to enroll

Enrollment typically involves providing personal identifying information, making your deduction election (how much you want to contribute from each paycheck), as well as setting up your investment allocations.

Individual 401(k) Plans

If you are self-employed with proof of earned income, you may also be able to contribute to a 401(k) by opening up an Individual or Solo 401(k). You would do this with a broker who offers such plans, like a Fidelity, Schwab or Vanguard.

Did you know 401(k)s have only been around since the 1980s?

Learn more about 401(k)s and how much you need to save for retirement here...

Other Employer-Sponsored Retirement Accounts

If your employer is not a for-profit company, your employer sponsored retirement savings plan may be called something else, though it functions essentially identically.

Non-profit and tax-exempt organizations, like schools, churches, hospitals, offer 403(b) Plans. State and local government employers offer 457 Plans. Both of these are subject to the same tax rules and contribution limits as a 401(k).

Government employees with 457 Plans have a few added benefits. In some cases, these employers may offer both a 401(k) or 403(b) AND a 457 Plan. In this case, you can fund both up to your annual wages. Also, 457 Plans do not incur a 10% penalty on early withdrawals.

Fun fact: employer-sponsored retirement plans are named for the the section of the IRS code that allows them to exist.

Traditional IRA

What if your employer doesn't offer an employer-sponsored plan or you are ineligible for your employer sponsored retirement plan? You can use an Individual Retirement Account, or IRA.

Anyone can open an IRA. With most major brokers, you can do so right online in minutes.

IRA Contributions

An IRA, like a 401(k) is also a tax-advantaged investment account. Your contributions are made with pre-tax income, reducing your current taxable income. Like a 401(k), the IRS sets an annual contribution limit for IRAs. In 2021, you can contribute up to $6,000 ($7,000 if you're 50 or older) to your IRA. Again, these contribution limits are adjusted over time, and you should check the IRS website for the current year's limits.

Can I Contribute to a 401(k) and an IRA?

If you or your spouse have a 401(k), you can also contribute to an IRA. However, your ability to deduct your contribution from your taxable income starts to phase out as your household income increases. For married couples filing jointly, if you have access to a workplace plan, the phase out range for 2021 is $105,000 to $125,000. If you are contributing to an IRA but do not have a workplace plan, but your spouse does, the deduction is phased out between $198,000 and $208,000. This reduces the amount of your IRA contribution you can deduct from your pre-tax income, before eliminating it entirely if you earn over the high end of these ranges.

IRA Investment Options

Unlike a 401(k) where your investment options are often limited to a set of funds pre-determined by the plan administrator, with an IRA you can invest in just about anything, just as you would with a brokerage account. Not only can you invest in mutual funds, you can also invest in ETFs, individual stocks and bonds, and more.

IRA Withdrawals

IRAs are subject to many of the same withdrawal rules as employer-sponsored retirement investment accounts. You cannot make withdrawals before the age of 59.5. Early withdrawals will incur taxes as well as a 10% early withdrawal penalty.

When you make withdrawals in retirement, the entire amount is subject to taxes at the current ordinary income tax rate.

How to Open a Traditional IRA

Want to use an IRA? Anyone can open an IRA with any major broker, and today the process can be completed almost entirely online. I personally have an IRA with Fidelity, but there are many other highly reputable banks or brokerage firms you can choose from. The Balance has a great analysis of IRA account offerings across different banks, including the pros/cons of each.

Wherever you open your IRA, make sure you understand the fees associated with the account - for trading, for transfers - as well as any minimum balance requirements. You should also understand what your investment options are. Large asset managers, like Fidelty and Vanguard, are attractive to many because of the large range of mutual funds they offer, many index fund options now at low to no management fees.

Roth IRA and 401(k)s, etc.

Your employer may also offer a Roth option on your employer-sponsored retirement savings account, giving you a choice between a Roth 401(k) or a traditional one. When you open an IRA, you also have the option between a Roth or Traditional IRA.

Annual contribution limits and withdrawal restrictions are similar for both. The key difference is the tax treatment of those contributions and withdrawals.

Roth Income Limitations

If you have access to a Roth 401(k) through your employer, there are no income limitations for contributions. However, if you wish to open a Roth IRA, you can only make contributions if your Modified Adjusted Gross Income (MAGI) - an official tax calculation as defined by the IRS - is below $208,000 for married filers, and $140,000 for single filers.

Roth Tax Treatments

The other key difference? Roth contributions are made with after-tax income, unlike traditional retirement account contributions. Why would anyone choose this option?

Because with a Roth, you make your contributions with after-tax income, paying income tax today, and never pay taxes on it again. When you make withdrawals in the future, so long as you follow the account rules, you don't ever pay taxes on the gains. With a traditional retirement account, you pay taxes at ordinary income rates on withdrawals.

Many people today are more interested in using Roth accounts because they believe tax rates will be higher in the future. They would rather pay taxes today, at current rates, than in the future at higher ones.

Best Tax-Advantaged Investments Accounts for College Savings

If you are adequately saving for your own retirement and want to save for your child's future college education expenses, there are also tax-advantaged investment accounts for that. You have three main options to consider: two different 529 plans - one that you invest and one that you prepay tuition with, or an ESA.

529 Plans for Education Savings

A 529 Plan allows families to save for education expenses on a tax-advantaged basis. There are two different types of 529 Plans: Education Savings Plan and Prepaid Tuition Plans. See more about the difference under the Investment Options segment below.

529 Plan Contributions

There are no federal tax benefits for the contributions to your account, so all contributions are made with after-tax income. However, depending on your state and whether or not you have state income taxes, there may be state tax benefits for using the 529 Plan offered by your state.

There are also no annual limits to how much you can contribute to a 529 Plan. However, some states do have lifetime contribution limits. The lowest of these are in Georgia and Mississippi at $235,000.

Friends and relatives can also make contributions to a 529 Plan. However, these can trigger gift tax liabilities for the donor if they exceed $15,000. Contributions to 529 Plans do allow for a one-time lump sum contribution of up to $75,000 without gift tax consequences, though the donor may not contribute again for 5 years.

All investment gains on your contributions are tax-deferred.

529 Plan Investment Options

There are two types of 529 Plans. More common is an Educations Savings Plan. In these plans, investment options are similar to a 401(k). You are given a list of mutual funds to choose from, selected by the plan administrator to choose from. Like a 401(k), you have to allocate the assets in your account to these investments in order to earn a potential investment return.

Related Post: Are You Worried About the Cost of College? The Private College 529 Plan

The other type of 529 Plans are Prepaid Tuition Plans. In these plans, a group of schools - often the public schools in a state - allow you to use your plan contributions to prepay for tuition credits at current tuition costs. Your child would then redeem these credits to pay their tuition in the future, no matter how much tuition costs in the future. The limitation here is that the prepaid tuition has to be redeemed at the schools participating in the plan.

529 Plan Withdrawals

The tax advantage of a 529 Plan comes from the tax-deferral on the gains, be they from investments or tuition costs rising, increasing the value of your prepaid tuition plan.

These gains remain tax-deferred forever so long as your withdrawals are used for qualified education purposes. This can be tuition, room and board, books, and more. In 2017, these tax benefits were expanded to not only include higher education, but also up to $10,000 in tuition expenses for private elementary and high school as well. A 529 Plan can also be rolled over to a 529 ABLE account, to pay for expenses for individuals with disabilities.

Many parents are concerned about what happens to the funds in their 529 Plan should their child not go to college. You have several options in this scenario, and in none of these options, do you lose all your money.

A 529 Plan is a savings account in your name. Your child is designated as the beneficiary. You can change the beneficiary at any time, to any child, or even a future grandchild. You can also simply withdraw the funds and use them. However, if not used for qualified education expenses, you will have to pay taxes on the gains plus a 10% penalty. There are also exceptions where the penalty is waived, including in the event of death or disability, receipt of a scholarship, and more.

For prepaid tuition plans, tuition credits must be redeemed at a school participating in the plan you choose. If your child chooses to go to school elsewhere, you can redeem the credits for cash value to be used to pay for school, though there may be fees or discounts applied to the cash value.

How to Open a 529 Plan

Every state has at least one, if not multiple, 529 Plan offerings. You can find the plans offered in your state here.

Related Post: How to Set Up a College Fund in Minutes

Most plans can now be set up online in literally minutes. All you need is personal identifying information, like Social Security and birthdate, for both yourself and your designated beneficiary. You will also need checking account information to fund the account. Many allow you to start with as little as $25, and also enable you to set up automated contributions going forward.

I recommend starting by looking at the plans offered by your state first - especially if you have a state income tax and the plans offer state tax benefits for contributions. Know that this does not limit your child to going to school in that state.

Be sure you know whether you are setting up a Savings Plan or a Prepaid Tuition Plan. Also, be aware of the difference between direct-sold plans, where you can set up your account online yourself with no upfront fees, and advisor-sold plans, which often charge an upfront fee on your investment.

Coverdell ESA

A Coverdell Education Savings Account was previously known as an Education IRA, and it works very similar to a Roth IRA, with contributions made after-tax. However, the withdrawals must be used for education expenses instead of retirement.

It used to be more attractive because it was the first to allow for payment of K-12 education expenses. However, now that 529 Plans permit that as well, it is less often used given its more signficant limitations.

You may only contribute $2,000 per year to a child's ESA, the child must be under the age of 18 during the year the contributions are made, and all the funds must be used or transfered before the child turns 30. Like a Roth IRA, there are also income limitations to contributing. Joint filers with MAGI of $220,000 or more ($110,000 for single filers) may not contribute to an ESA.

The one attraction of an ESA over a 529 Plan is, like an IRA, there are more investment options available to you, as opposed to being limited to a set of funds pre-determined by the Plan Administrator in a 529 Plan.

Other Tax-Advantaged Investments Accounts

The one other tax-advantaged investment account for beginners to be aware of are Health Savings Accounts.

Unlike other Flexible Spending Accounts, typically offered through your employer, Health Savings Accounts allow you to carry funds over from year to year and invest them. Other Flexible Spending Accounts allow you to save and pay for qualified expenses with pre-tax dollars, but you must use the funds in the current year or lose them.

Health Savings Accounts

Health Savings Accounts are tax-advantaged savings accounts used to pay for qualified medical expenses.

HSA Eligibility

Unlike other tax-advantaged accounts that have no eligibility requirements or are only limited by income, HSAs are currently only available to people with "high deductible health plans (HDHP)."

The definition for this is set each year by the IRS. For 2021, a HDHP is defined as

"a health plan with an annual deductible that is not less than $1,400 for self-only coverage or $2,800 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $7,000 for self-only coverage or $14,000 for family coverage."

- Internal Revenue Service

If your health insurance plan meets these requirements, you are eligible to contribute to an HSA.

HSA Contributions

HSA contributions are made with pre-tax income, and the IRS also sets the amount you can contribute. For 2021, you can contribute up to $3,600 if you have self-only coverage under your HDHP, and up to $7,200 if you have family coverage under a HDHP.

HSA Investment Options

HSA Investment Options may vary. Some just allow you to carry over your funds from year to year and earn a set interest rate. Other HSA investment options are more like those you would see in a 401(k), giving you a list of pre-set mutual funds selected by the plan administrator.

All gains on your investment are tax-deferred.

HSA Withdrawals

Withdrawals from an HSA can be used at any time so long as they are used for qualified medical expenses. This can be for any medical treatment, including vision and dental care.

If you withdrawal the funds before age 65 for non-qualified medical expenses, the funds are subject to ordinary income tax plus an additional 20% penalty.

After the age of 65, an HSA can be treated like a retirement account with withdraws for non-medical expenses, ordinary income taxes paid, and no penalty incurred.

How to Open a Health Savings Account

Some employers offer an HSA as part of your benefits package if they also have a HDHP.

You can also open an HSA if you qualify with major investment managers, like Fidelity. Morningstar has a great rating of the best HSAs if you want to explore your options.

Best Taxable Investment Accounts for Beginners

Last, but not least, if you have exhausted your tax-advantaged options and/or you want free, unrestricted access to your funds with nearly limitless investment options, you may want to explore a traditional brokerage account.

Investing Tax Treatment

Unlike the tax-advantaged options, neither your contributions nor gains have any tax savings in a brokerage account.

Every time you sell an investment, you will realize and pay taxes on any gains, known as capital gains. Capital gains are characterized as short-term or long-term. If you hold an investment for less than a year, your capital gains (or losses) are short-term. If you hold an investment for more than an year, your capital gains (or losses) are long-term.

Each year, you net your losses from your gains in each category. Your net short-term gains are taxed at your ordinary income tax rate, no matter your income level. Your net long-term gains are taxed at 0%, 15%, or 20% depending on your overall income level, as depicted in the table below.

You can only deduct up to $3,000 in investment losses in any given year. If your losses exceed that amount, you can carry the loss forward to be used against gains in later years.

The single best way to minimize taxes in your investment gains? Buy and hold for the long-term. You only incur taxes when you sell an investment and realize a gain.

How to Open a Traditional Brokerage Account

There are many brokers to choose from when it comes to choosing where to open a traditional brokerage account. Today, almost all allow you to open and fund your account right online.

What should you look for? Pay attention to any account balance minimums, as well as trading fees. Most now charge nothing for basic stock trades online. If you think you might want to relocate your account some day, look at the transfer fees as well.

Reputations matter too. Make sure the firm is a FINRA member and your funds are protected by SIPC. This protects your rights as a retail investor and also protects your funds in the event a broker-dealer goes out of business. These affiliations should appear in their website footnotes.

How to Choose the Best Investment Accounts for Beginners

So, how do you choose from all these investment account options? Start with the key questions:

1a. Do you want a taxable or tax-advantaged account?

1b. When do you want access to the funds?

If you need access to your funds inside of 2 years, you shouldn't be investing. If you need access in the medium-term, a brokerage account is likely the right option. If you can wait for the long-term...

2. What are you saving for?

Depending on if you are saving for retirement, college, or health expenses, this answer will guide you the right answer here.

Answers to those questions should guide you in the right direction. Once you've chosen your account, invest consistently for the long-term.

Next up in the Investing for Beginner Series? Understanding Different Types of Investments. This includes the Core 3 - like Cash, Stocks and Bonds - and the variations within them, like Growth, Value, Large Cap, Small Cap that you'll find mixed into the various mutual fund and ETF options out there. Understand these, and you'll better understand your investment options.

Save this for later? Pin IT!

[…] invest, all the options and choices can feel completely overwhelming. Once you’ve chosen the best investment account for you, you may be staring at a list of funds, with all different types of investments, and […]

[…] here to learn more about the best investment account options for retirement. Wondering how much you need to save for retirement? Check out the retirement calculator below to […]

[…] As an educator, you are offered unique retirement account options. Investing money, including investing funds into your retirement accounts, allows you to put this specific money to work and create passive income. […]

[…] Related post: How to Choose the Best Investment Accounts for Beginners […]